Health insurance most of us have yet to learn about that, It is one of the important components of the medicare system where people get financial assistance for the increased prices in the healthcare industry. Health insurance aims to provide medical expenses for families who can not afford them. We do not have any idea about what happens to our health the next day we may meet with an accident, we may have any disease diagnosed in our body or any health-related problem, so we can not afford too much amount of money or we can not put all our savings at one time for a health issue so we need to be aware of the insurance plans which will help us with our financial crisis. The cost of medicines, surgeries, doctor consultations everything is in inflation due to the over demand for health care. To reduce the risk of overburdening yourself with health problems you need to take a health insurance plan that will help you in assisting you financially with doctor consultations, hospitalization, surgery, accidents, medical bills, etc.

The first thing you should keep in mind while taking health insurance is to thoroughly check the terms and conditions mentioned in the insurance papers because many scams are going on all over the world, especially in India, you will not read the terms and conditions and then the insurance company may fool by reducing the claim amount or rejecting the claim or via many other ways. So, thoroughly check the terms and conditions and then sign the papers, if you are doing it online, do go for an insurance plan after getting a clear knowledge about the insurance plan.

We understand what health insurance is and why we need that now let’s understand what are the types of health insurance and what are the things we should keep in mind while taking a health insurance plan.

There are four main types of health insurance plans:

1)Individual health insurance:

This is suitable for a single person. The individual will get assisted with all his medical expenses such as hospitalization, surgery, pre and post-hospitalization charges, and medical bills.

2)Family health insurance:

The family health insurance plan is for people who want to take a single insurance plan for the whole family including spouses, children, and parents. For elder people as parents, you need to take a different floater as they may have pre-existing health issues there will be other things included in the plan so, you need to take two floaters in a family health insurance plan.

3)Senior citizen health insurance:

For people who are aged above 60 years depending upon the plan that you are choosing, the people who want to take health insurance after they become older or the people who want to take health insurance for their parents this health insurance plan will be best suitable for them. The insurance will include a maximum of their medical expenses including their pre-existing health issues.

4)Critical illness health insurance:

This health insurance plan is suitable for people who have serious health issues such as heart problems, cancer, diabetes, kidney failure, paralysis, and many other health problems will be included under this plan depending upon the policy you choose.

The above four are the main types of health insurance there may be other types of health insurance also.

Points to remember while taking health insurance:

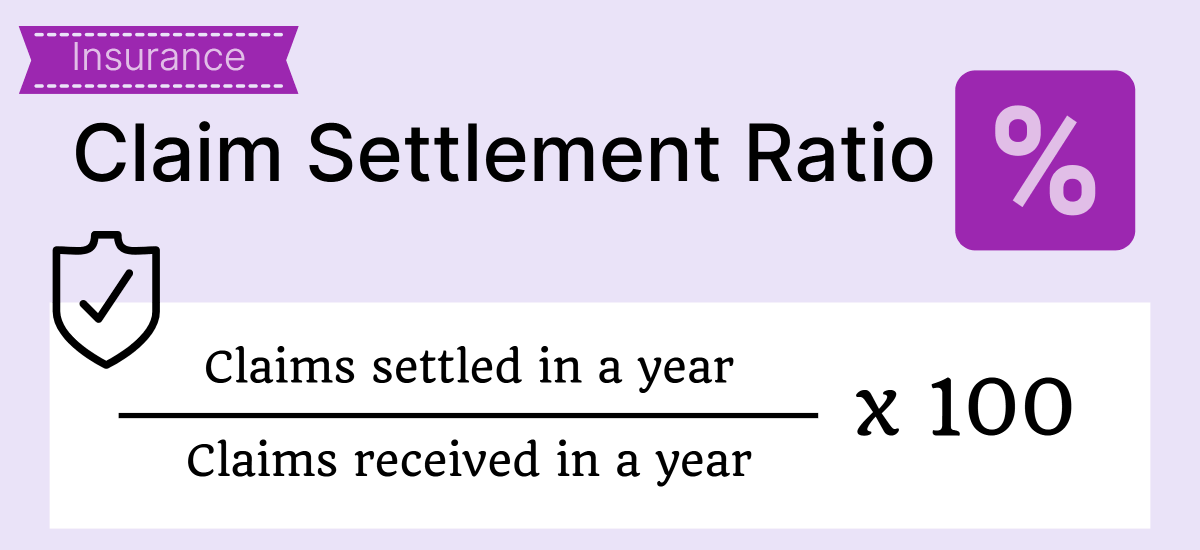

1)Claim settlements ratio:

It should be more than 96% that is if a company is paying 90 claims out of 100 its claim settlement ratio is 90%. The higher the claim settlement ratio higher you will benefit from the health insurance company in terms of claims.

2)Networking hospitals (the hospitals that are included under your health insurance plan)should be more in your selected area under the insurance plan you are taking because if the networking hospitals are more it will be easy for you to claim the benefits of the plan.

3)For insurance plans with pre-existing diseases, the waiting period should be less i.e, after taking a certain insurance plan your waiting period to claim the amount should be less because if your health issue gets serious then due to the waiting period you can not claim the insurance within a short time so better go for plans where the claim waiting period is less for pre-existing health issues.

4)Most people have a common doubt about what insurance plan they should take. So, there are many policies available in the market you can choose the right one according to your purpose, the amount you can invest, if you have any existing health issues, what amount you want to claim, and what things you want to include in the plan.Based on those things you can choose the right insurance plan.

5)When should one take an insurance plan? So if you are a younger individual without any health issues, if you are in your 20s and 30s, and if your income is also good it will be better if you start taking health insurance.

6)If the restoration time for claiming the insurance is not suitable for your health issue it's better not to go for that plan.

7)There should be fewer sub-limits for the room rent charges, medical expenses surgeries, etc. If your charges are more you may receive a reduced claim amount so read the terms and conditions clearly for a basic idea of the claim amount for each component.

8)Pre and post-hospitalization charges must be included in the health insurance plan.

9)There will be two types of claim process:

A cashless claim in which the hospital will directly claim the amount from the insurance company and a reimbursement claim in which the policyholder will pay his/her medical expenses first and then ask for reimbursement from the health insurance company.

The above information will give you a basic idea about a health insurance plan. If you are someone willing to take a health insurance plan, soon get a complete idea about the plan and then go for taking it because, without a clear understanding, you may invest your money in the wrong place. So do take health insurance which will be very helpful for your emergency medical expenses.